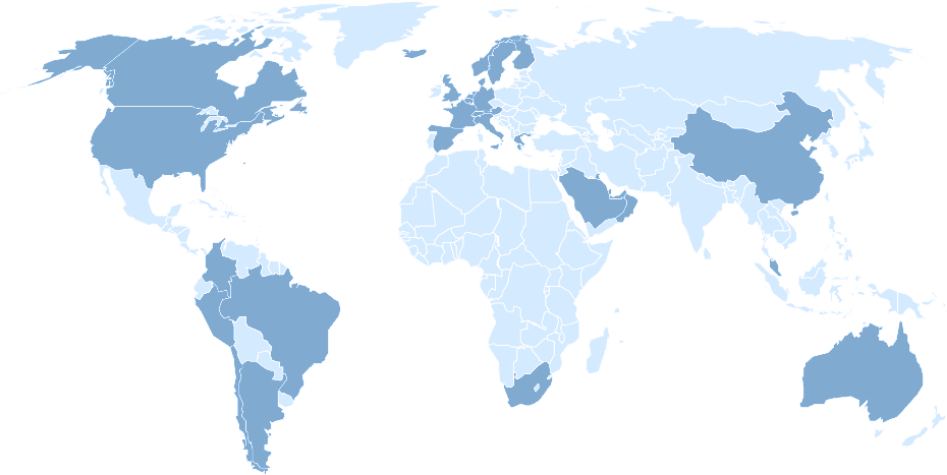

Palm Beach

New York

London

Malaysia

Frankfurt

Paris

Keel Harbour Capital Limited is registered in England and Wales (Reg. #10249854), registered office 7 Savoy Court, London WC2R 0EX. Keel Harbour Capital Limited (FCA #773791) is an appointed representative of Crito Capital LLP (FCA #681420), authorised and regulated by the Financial Conduct Authority. Securities in US offered through Frontier Solutions, LLC. Member, FINRA and SIPC.